Flow – Staking Guide

The Flow blockchain is a particularly green blockchain thanks to its energy-efficient proof-of-stake consensus mechanism. Find out what problem Flow addresses, what solution the blockchain has for it and how Flow can be staked.

Since 2021, Deutsche Telekom MMS has been providing computational infrastructure for the Flow Blockchain. With over 18 million user accounts and an average transaction fee of just 0.001 cents, the Flow Blockchain has emerged as a leader in the NFT space, particularly recognized for its energy-efficient Proof-of-Stake consensus mechanism. This positions Flow as one of the "green" blockchains.

The Problem

When choosing a blockchain to build a project, factors such as scalability, speed, and both initial and ongoing costs play a decisive role. Popular "NFT-powered dApps" like Opensea, Rarible, and Axie Infinity have enjoyed significant popularity in recent years. However, the increasing demand for such applications led to severe network congestion on Ethereum, which lacks sufficient scalability for such use cases.

For example, the 2017 launch of CryptoKitties caused Ethereum to experience massive network overloads, with transaction fees skyrocketing to hundreds of dollars. This highlighted the urgent need for a scalable solution.

The Flow Approach

The Flow Blockchain was specifically designed for Web 3.0 applications, such as NFTs, blockchain-powered games, and metaverse projects. Its solution to the scalability challenge is a multi-role infrastructure. This system divides network nodes into different categories based on their role, effectively distributing the workload (e.g., transaction validation) across the network for maximum efficiency.

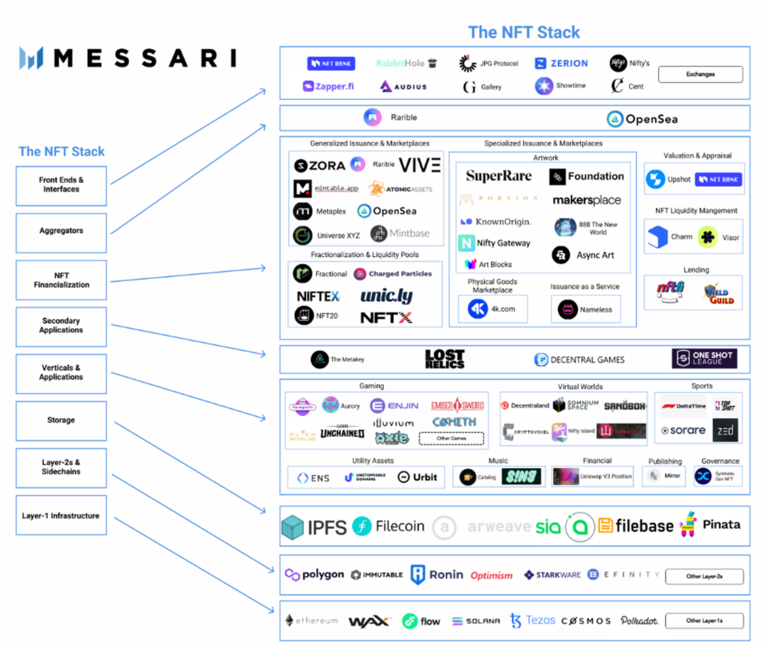

Ecosystem

Flow has developed a vast network of partnerships. The ecosystem’s most prominent success to date is the digital collectible project NBA Top Shot, which has generated over $1 billion in trade volume through primary and secondary marketplaces. In 2024 Flow deployed the Crescendo Update to introduce full EVM equivalence.

Step-by-Step Staking Guide

Disclaimer: This guide provides a technical walkthrough of the staking process and does not constitute financial investment advice. Deutsche Telekom MMS is not liable for any losses incurred through staking on the Flow protocol or similar processes.

To stake Flow tokens, you’ll need a software wallet like Blocto, Port Onflow, or Dapper Wallet. For hardware wallet users, Ledger is supported. This guide will use the Blocto wallet as an example.

Step 1: Setting up your Wallet

- Visit the Flow Port platform.

- Click on the SignUp button to create an account.

- Choose the wallet "Blocto" and provide the desired email address for your account.

- After logging in, you’ll see the dashboard. Your wallet address is displayed under Your Address.

Step 2: Funding Your Wallet

- Transfer the Flow tokens you’ve acquired to your wallet address.

- Check your balance under the Balances section to ensure the tokens have arrived.

Step 3: Activating Staking

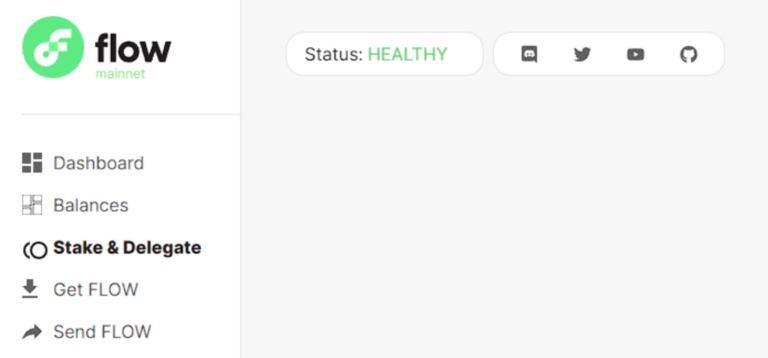

- Navigate to the Stake & Delegate section.

- Activate your account by clicking Upgrade and then Continue.

- Once activated, the Delegate button becomes available.

Step 4: Delegating Your Tokens

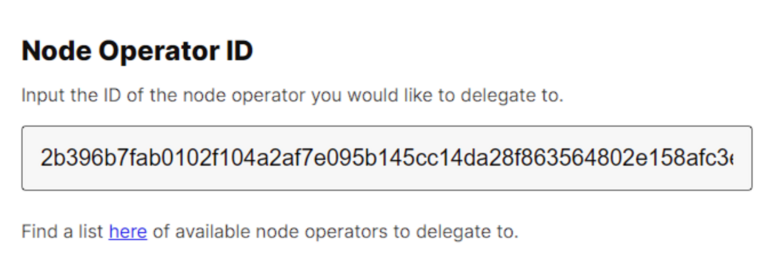

- Choose a preferred node to delegate your tokens to. Enter the node’s ID - e.g., our MMS Node ID: 9f264537d1a2e2ab0baad9dbec599d2d8d7817f969a3851572c82a5dffdbbeb7

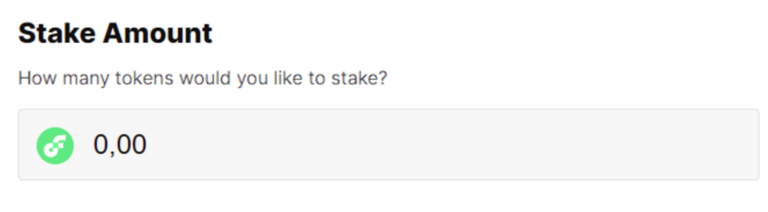

- Specify the number of tokens you want to delegate. Ensure you leave at least 1 Flow token in your wallet for future transactions.

Step 5: Monitoring Your Staking

- Your tokens are now successfully delegated and staked.

- Under the Stake & Delegate section, you can see when the delegation becomes effective.

- Rewards earned through staking will appear under Available Rewards as they accumulate.

Step 6: Liquid Staking

- Liquid staking literally keeps your staked asset liquid without any lock-up period unlike traditional staking

- Earn staking rewards while using the staked assets in lending, borrowing, or yield farming for additional returns.

Liquid Staking for FLOW:

- Stake Flow and receive stFLOW on Increment.fi. Use your LST to provide liquidity or for your favorite DeFi activity.

- Stake Flow and receive ankrFLOW on ankr.com. Use your LST for like yield farming, lending, or liquidity pools.

Be aware that liquid staking can involve multiple risks such as smart contract vulnerabilities, slashing, liquidity shortages or depegging.

Important Notes

- If you decide to unstake your tokens, you must account for the "unbonding period", which can last between 7 and 14 days. Tokens will only become accessible after this period.

- Always keep your wallet secure, and only delegate to reliable and reputable validators to minimize slashing risks.